Content

That have an excellent $step 1 put, the advantage might possibly be small— for example, a 100% matches provides you with simply $step one more. Not every 1 dollars deposit incentive is the same, because they can provides different conditions and terms. Find the deal that suits you by far the most before making a decision to the an online gambling establishment. Ruby Fortune is actually a casino launched in the 2003 with a well-organized web site and you may affiliate-friendly software. But really, it series upwards our very own greatest $step 1 put casino listing for its strong extra give and you may crypto help. Today, the brand new 200x betting importance of the fresh product sales wasn’t the simplest to accomplish.

$10 put casinos

For those who return to the tax home away from a short-term project on the months of, you aren’t experienced on the move when you’re in your hometown. You could’t deduct the cost of meals and you may rooms here. But not, you can deduct your traveling expenditures, in addition to foods and accommodations, whilst travelling between your short term office along with your income tax house. You can claim these types of costs to the amount it would has charge a fee to keep at the temporary place of work. For the past 5 years, Davida provides concentrated the woman talking about playing, especially casino poker.

Shell out by Look at otherwise Currency Buy With the Estimated Income tax Fee Voucher

The standard meal allowance is for an entire twenty four-hour day’s travel. For many who travel to have element of twenty four hours, such as on the weeks your depart and you will return, you must prorate an entire-time Yards&Web browser rates. That it signal in addition to is applicable if your employer uses the standard federal for each and every diem rate or the large-low-rate. To own travelling inside the 2024, the pace for many small localities in the united states are $59 a day.

For those who discover a check to have a refund you aren’t eligible to, or for an enthusiastic overpayment which should was credited to help you projected tax, never bucks the newest look at. Do not consult a deposit of any section of your own refund so you can an account this is not on your identity. Don’t let your tax preparer to help you deposit people part of your own reimburse to your preparer’s membership. What number of direct deposits to a single membership otherwise prepaid service debit credit is restricted to three refunds a year. After that limit is exceeded, papers inspections would be sent as an alternative. That it finance assists purchase Presidential election ways.

Such, when the an on-line sportsbook has to offer a one hundred% very first deposit added bonus as high as $100, people should basic put the full $100 to make the greatest bonus you are able to. The fresh acceptance added bonus during the Parlay Gamble is a form of first-deposit added bonus. Parlay Gamble often borrowing from the bank the fresh players a 100% put matches extra all the way to $100. These types of incentive finance are able to be used to enter into some of the newest competitions to be had by this program.

Your use in income only the number you get one’s over your genuine costs. You’ve got acquired a mrbetlogin.com Recommended Site form W-2G, Particular Betting Payouts, demonstrating the degree of your own betting profits and one income tax drawn out of them. Are the amount of field step 1 for the Agenda step 1 (Setting 1040), line 8b.

- The brand new interpreter’s characteristics are utilized simply for your projects.

- If worth of disregard the rises, you get a profit.

- A good example of these types of interest are a hobby otherwise a ranch your work mainly to own sport and fulfillment.

- Making this option, over Mode W-4V, Voluntary Withholding Consult, and provide it on the paying work environment.

A personal member to own a good decedent changes out of a shared return decided to go with by the surviving partner so you can a different come back to have the new decedent. The private member features one year on the due date (as well as extensions) of the go back to make changes. 559 for more information on submitting money to own a good decedent. For many who remarried before the avoid of one’s income tax year, you could file a joint return with your the new mate. Their deceased wife or husband’s processing position try partnered filing independently for that season. You might have to spend a penalty for individuals who document an erroneous claim to have reimburse or borrowing.

- The fresh 50% limitation often implement after choosing the amount who would if not be considered to possess an excellent deduction.

- We have the answer with our constantly up-to-date list of the fresh no-deposit casinos and you may bonuses.

- These types of quantity are typically used in money on your own return to own the season which you converted them out of a classic IRA to help you a Roth IRA.

- The brand new T&Cs during the $step one put gambling enterprises can frequently hunt perplexing considering the sheer number of information.

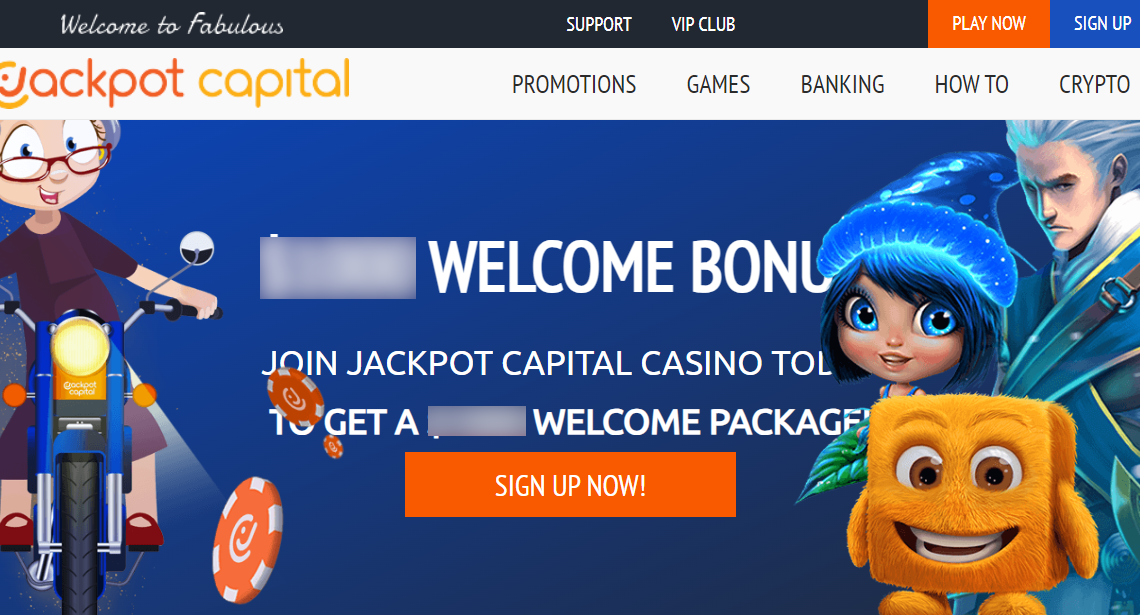

Right here, we’ll make it easier to discover the best one dollar lowest put gambling enterprises to match your enjoy design and you will expand their money. The net casinos render bonuses and offers which are stated having a great $1 put. Cash bonuses is actually strange, but casino borrowing, bonus gamble and you can extra revolves is given so you can the newest and you may going back players. Added bonus revolves is generally linked with a finite level of video game otherwise a single slot sometimes.

A fee-basis state government authoritative pushes ten,100000 miles during the 2024 for team. Under their workplace’s responsible bundle, it take into account the amount of time (dates), place, and team purpose of for each excursion. The boss pays him or her a mileage allotment out of 40 dollars ($0.40) a distance.

The brand new Company from Defense kits for each diem cost for Alaska, Hawaii, Puerto Rico, American Samoa, Guam, Halfway, the new North Mariana Islands, the brand new You.S. Virgin Countries, Aftermath Isle, and other low-overseas portion outside the continental United states. The fresh Service from County set per diem cost for all almost every other international parts. A bona fide business purpose can be found if you can show a good real business purpose for the personal’s exposure. Incidental functions, for example typing cards otherwise assisting inside the humorous consumers, aren’t sufficient to make expenses deductible. Such, you must allocate your expenditures if a resorts boasts one to or far more food in room charges.

But not, benefits produced as a result of a flexible investing or comparable plan supplied by your employer should be included in your income. So it amount will be claimed since the wages fit W-dos, box step one. To find the display of your own taxation to your joint go back, earliest contour the fresh taxation you and your mate would have paid got your filed separate efficiency to own 2024 utilizing the same submitting reputation for 2025. Next, proliferate the fresh tax for the mutual get back by following the tiny fraction.

Recent Comments